Finally Pengbears has been released for iOS! You can now download the game for iPhone and iPad for free on App Store.

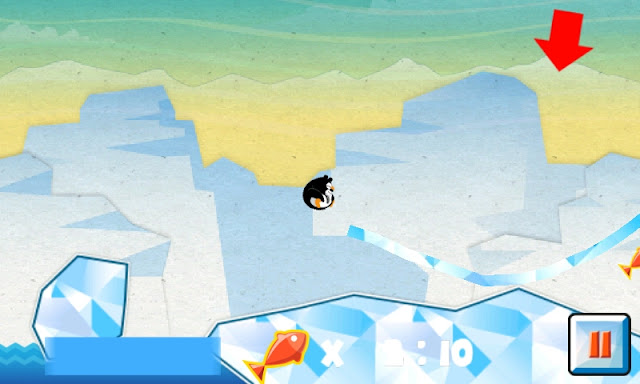

In Pengbears you use your finger (or mouse if playing on Facebook) to draw ice. The ice is used by the Pengbears to slide around to catch fish

To download Pengbears for iOS, either search for "Pengbears" on App Store, or go to this url: http://itunes.apple.com/th/app/pengbears-free/id544707017?mt=8

You can watch this video to learn how to play the game:

Pengbears website: http://www.pengbears.com

In Pengbears you use your finger (or mouse if playing on Facebook) to draw ice. The ice is used by the Pengbears to slide around to catch fish

To download Pengbears for iOS, either search for "Pengbears" on App Store, or go to this url: http://itunes.apple.com/th/app/pengbears-free/id544707017?mt=8

You can watch this video to learn how to play the game:

Pengbears website: http://www.pengbears.com